All Categories

Featured

Table of Contents

Life insurance policy covers the insured person's life. If you pass away while your plan is active, your recipients can utilize the payment to cover whatever they pick medical bills, funeral prices, education and learning, loans, everyday costs, and also financial savings. If you have a policy, conduct routine life insurance evaluates to ensure your beneficiaries are up to day and know just how to assert life insurance policy coverage if you pass.

Relying on the condition, it may influence the plan kind, price, and insurance coverage quantity an insurance provider supplies you. It is necessary to be sincere and clear in your life insurance policy application and during your life insurance policy clinical examination failing to reveal inquired can be thought about life insurance policy fraud. Life insurance policy policies can be categorized right into three primary groups, based on just how they function:.

What is the difference between Term Life and other options?

OGB supplies two fully-insured life insurance strategies for workers and retired people via. The state shares of the life insurance policy costs for covered workers and senior citizens. Both strategies of life insurance policy offered, together with the equivalent amounts of dependent life insurance coverage provided under each plan, are kept in mind listed below.

Term Life insurance policy is a pure transference of risk for the payment of premium. Prudential, and prior carriers, have been offering insurance coverage and thinking threat for the repayment of costs. In case a covered person were to pass, Prudential would honor their obligation/contract and pay the benefit.

Plan members presently enlisted that want to add reliant life coverage for a partner can do so by providing evidence of insurability. Employee pays 100 percent of dependent life costs.

2018 Prudential Financial, Inc. and its associated entities. Prudential, the Prudential logo, the Rock symbol, and Bring Your Obstacles are service marks of Prudential Financial, Inc. and its relevant entities, registered in many territories worldwide.

How do I choose the right Trust Planning?

The price framework allows staff members, partners and domestic partners to pay for their insurance based upon their ages and chosen protection amount(s). The optimum assured issuance amount available within 60 days of your hire day, without proof of insurability is 5 times your base yearly salary or $1,000,000, whichever is much less.

While every attempt has been made to make certain the precision of this Summary, in case of any discrepancy the Recap Plan Summary and Strategy Document will prevail.

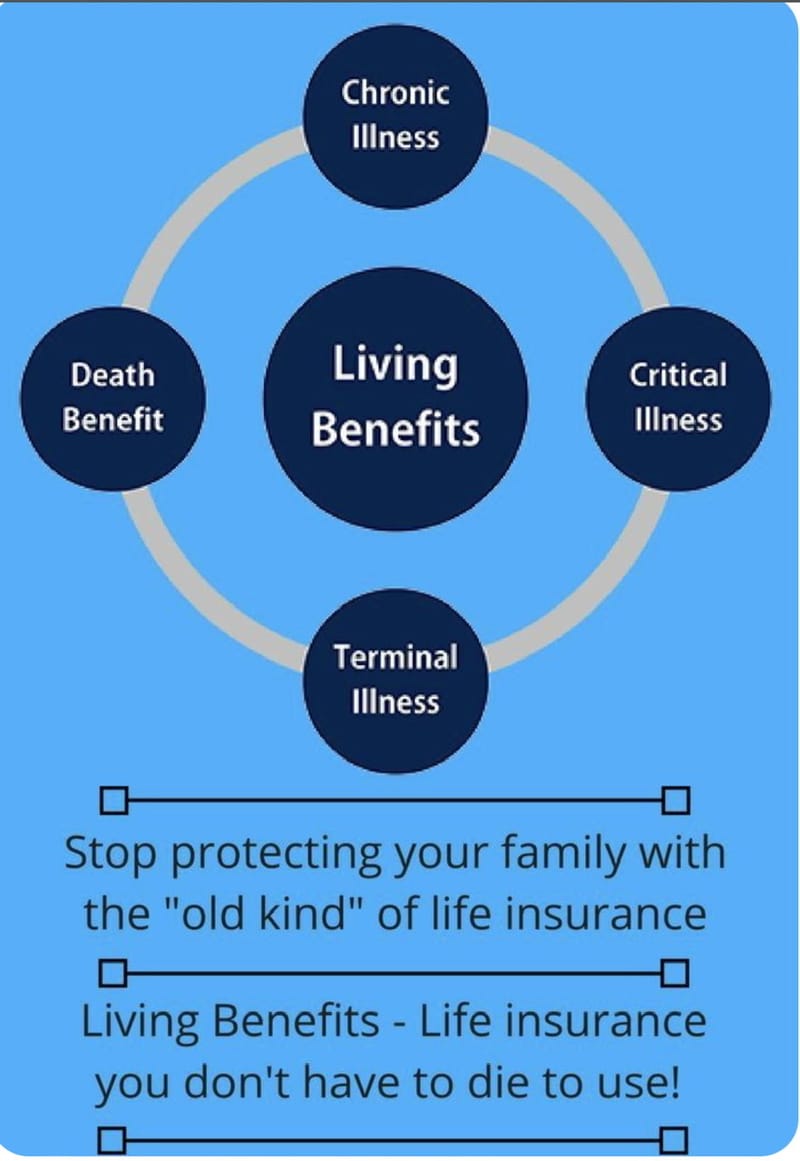

What takes place when the unanticipated comes at you while you're still to life? Unexpected diseases, lasting handicaps, and much more can strike without warning and you'll intend to be all set. You'll want to see to it you have options offered just in case. Fortunately for you, plenty of life insurance policy plans with living advantages can provide you with financial help while you live, when you need it the a lot of.

, however the benefits that come with it are part of the factor for this. You can include living benefits to these strategies, and they have money value growth capacity over time, implying you might have a few various options to utilize in situation you need moneying while you're still alive.

Who offers flexible Retirement Security plans?

These plans may enable you to add certain living advantages while additionally permitting your strategy to accrue cash value that you can take out and use when you need to. resembles whole life insurance in that it's a long-term life insurance coverage policy that indicates you can be covered for the remainder of your life while taking pleasure in a plan with living benefits.

When you pay your premiums for these plans, component of the settlement is drawn away to the cash money worth. This money worth can expand at either a taken care of or variable price as time proceeds relying on the sort of plan you have. It's this amount that you may be able to access in times of demand while you're to life.

The disadvantage to utilizing a withdrawal is that it could raise your premium or lower your death benefit. Surrendering a policy basically indicates you've terminated your policy outright, and it instantly gives you the cash money worth that had built up, less any type of abandonment fees and superior policy expenses.

Making use of cash worth to pay costs is essentially simply what it sounds like. Relying on the kind of plan, you can use the cash money value that you have actually accumulated with your life insurance policy policy to pay a portion or all your premiums. A living advantage motorcyclist is a kind of life insurance motorcyclist that you can contribute to your life insurance plan to use in your life time.

Why should I have Beneficiaries?

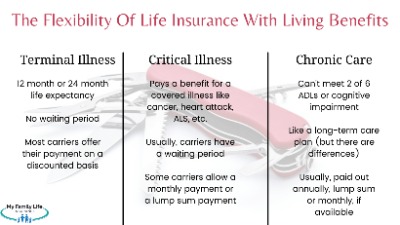

The terms and quantity readily available will certainly be defined in the policy. Any living benefit paid from the fatality advantage will certainly lower the amount payable to your recipient (Level term life insurance). This payout is implied to help offer you with convenience for completion of your life along with aid with clinical expenditures

Crucial ailment rider ensures that benefits are paid straight to you to pay for therapy services for the disease defined in your policy agreement. Long-lasting treatment cyclists are placed in location to cover the expense of at home treatment or assisted living home expenditures as you age. A life negotiation is the procedure whereby you offer a life insurance policy policy to a 3rd party for a round figure payment.

What is Death Benefits?

That depends. If you're in a permanent life insurance policy plan, after that you're able to withdraw money while you're active via lendings, withdrawals, or giving up the policy. Prior to making a decision to touch right into your life insurance policy for cash money, consult an insurance policy representative or representative to determine how it will certainly impact your recipients after your death.

All life insurance policy plans have one point in usual they're created to pay money to "named beneficiaries" when you die. Term life insurance. The recipients can be one or even more people or also a company. In many cases, plans are purchased by the person whose life is insured. Life insurance policy policies can be taken out by spouses or any individual that is able to prove they have an insurable passion in the person.

What are the top Family Protection providers in my area?

The plan pays cash to the called beneficiaries if the insured dies throughout the term. Term life insurance policy is intended to provide lower-cost insurance coverage for a specific duration, like a 10 years or 20-year period. Term life plans may consist of an arrangement that permits insurance coverage to continue (restore) at the end of the term, also if your health and wellness standing has actually transformed.

Ask what the costs will certainly be prior to you restore. Likewise, ask if you lose the right to restore at a certain age. If the policy is non-renewable you will require to make an application for coverage at the end of the term. is different since you can maintain it for as long as you require it.

Table of Contents

Latest Posts

Instant Online Life Insurance Quote

Senior Burial Insurance

Final Cost

More

Latest Posts

Instant Online Life Insurance Quote

Senior Burial Insurance

Final Cost